Investors Flock to Yushu's Old Shares Starting from 5 Million

Advertisements

Recently, the world of investment has been abuzz with news of "Yushu's old shares," stirring excitement and speculation among investors eager to secure their position in what many consider an unprecedented opportunity. One venture capitalist expressed his frustration in an online forum, lamenting, "I can’t get my hands on Yushu's old shares, and there's just too much business planning from robotic companies to digest." The high-stakes game of acquiring these shares has ignited a frenzy, with notable projections that Yushu's valuation could soar from 8 billion yuan to a staggering 20 billion yuan in the upcoming funding round.

Yushu technology, a prominent player in the field of embodied intelligence, has attracted attention for its extraordinary projected returns, with some investors estimating returns that could exceed ten times the initial investment. Such a prospect has made the opportunity to invest in Yushu nothing short of a golden ticket in investment circles, with stakes beginning at 5 million yuan almost drawing a rush of investors clamoring to get in.

In an intriguing turn of events, Ethan, an investor who became privy to Yushu's old share transfer project just three days before the Chinese New Year, described the opportunity as a well-deserved perk for his clients. He noted that expectations of a tenfold return are modest at best. Indeed, the data reveals that since its inception, Yushu has undergone nine funding rounds, with each round (except for a modest 2 million yuan angel round in 2017) typically generating several hundred million yuan.

However, not every investor has captured this opportunity. One individual reflected on a previous decision to invest instead in a rival robotics company based in Hangzhou, pinpointing his reasoning in team stability over Yushu's more unorthodox background. He stated, “Based on my investment experience, the team at the other firm seemed more reliable.” His comments highlight a common narrative where the educational pedigree of a startup’s founding team often plays a critical role in the preliminary evaluation of potential investments.

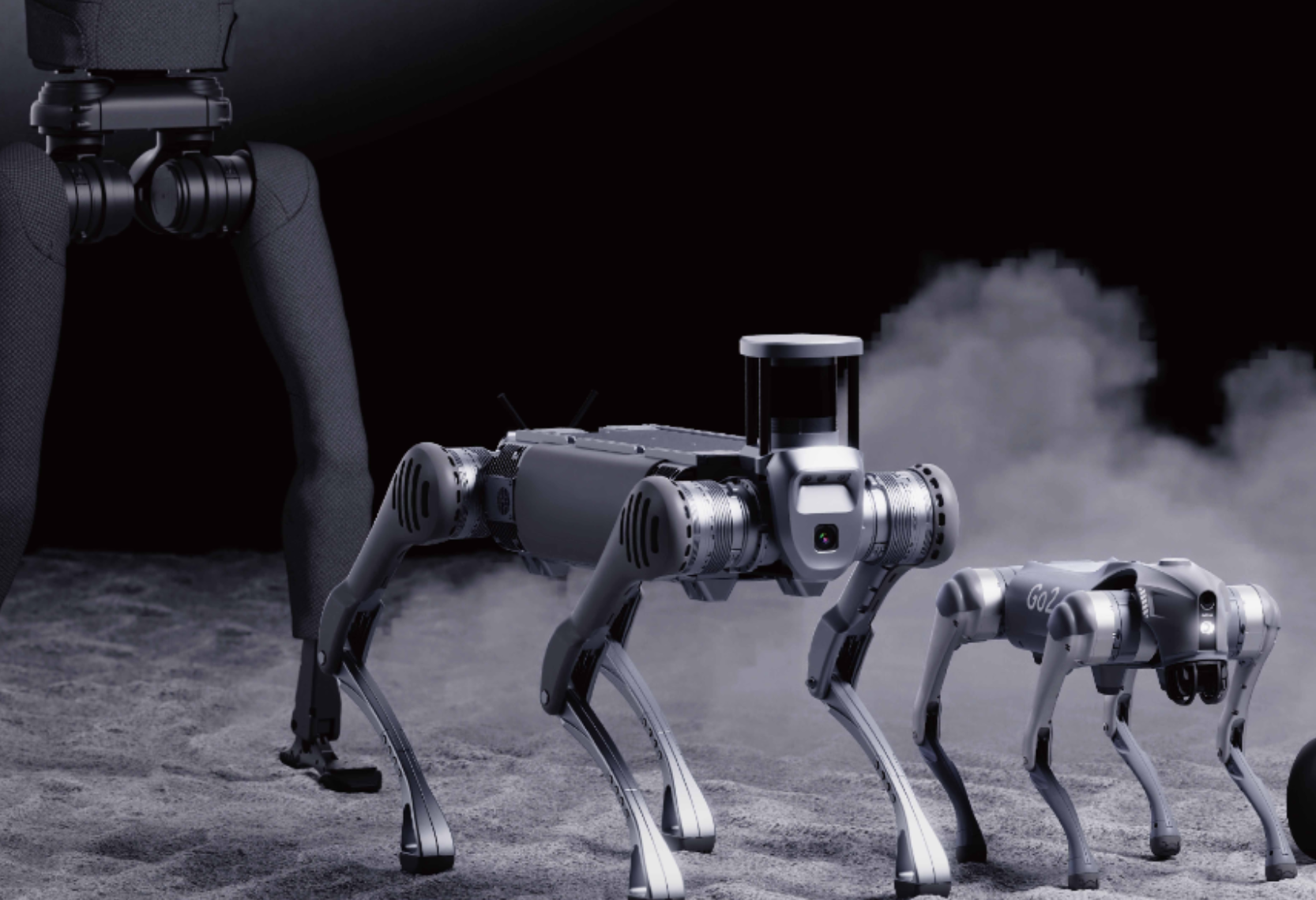

The founding team of Yushu, particularly its head, Wang Xingxing, does not boast an educational pedigree from elite institutions in the same way as some competitors. Yet, Wang's journey to robotics innovation—a serendipitous turn after a setback during his graduate entrance examinations—proves that sometimes unconventional routes lead to groundbreaking inventions. He developed XDog, a robotic canine capable of movement comparable to the renowned BigDog developed by Boston Dynamics, powered solely by electric drives.

Analysts, including Liu Rong of Liwei Yuan Capital, point out that Yushu's evolution from quadropedal to bipedal technology signifies a rapid iterate adaptation, enabling the company to lock in a commanding market presence. By 2025, at the Consumer Electronics Show (CES), Yushu reported an impressive global market share of 60%-70% in the quadrupedal robot segment. This achievement underpins the company's strength as a leading contender in the robotics landscape and attracts substantial international capital interest, with around 40% of prospective investors hailing from overseas markets with a dollar fund backdrop.

As discussions surrounding the next round of valuations heat up, there is palpable speculation that Yushu's projected worth could double. Observations from Ethan indicate that while the flow of capital in the private equity market is somewhat unforeseen, the premise is that the old shares aren't merely being sold—rather, an institution with funding gaps from an earlier investment round is essentially providing an opportunity to reinject capital, signaling robust market confidence.

For institutional investors, the possibility of seizing a stake in a leading project is inviting, as it positions their funds attractively for future fundraising efforts. Liu emphasized that even if immediate liquidation seems improbable, strategies like "downround exits" might create valuation advantages over time. Considerations are abound that with Yushu's impending valuation set to potentially hit 20 billion yuan, making the initial investment now could reward stakeholders handsomely in the coming years.

The robotics industry as a whole finds itself at a pivotal juncture, as Liu noted the surge in interest surrounding financing for core component suppliers. The continuous demand arising from the broader implementation of robotics throughout varied sectors—from automotive to manufacturing—indicates that the financial models holding these partnerships are evolving into more stable enterprises. However, investors must remain patient, as these cycles may extend to 5-10 years, reflecting the inherent lengthiness of technological development and market adaptation.

Pan Tao of Dingxin Capital echoed those sentiments, indicating a shift in focus toward emerging fields within the robotics realm this year. These domains range from fundamental robotic bodies to developments in cognitive computing, component manufacturing, algorithms, and training data analytics—all critical facets of the expansive robotics ecosystem.

The complexity of the supply chains involved in robotics presents additional layers of challenge. Pan believes that the evolution of professionalized and customized components alongside the convergence of advanced models will emerge as the market matures. He noted, “Current intelligent robots still fundamentally rely on traditional industrial control systems. The road ahead will take time as we grapple with substituting human tasks with robots.”

This lengthy journey toward operational implementation highlights the importance of strategic positioning during early-stage funding, creating balance across various resources including human capital, finances, materials, production, supply, and sales. Ultimately, however, the pressing question remains: how will enterprises navigate prolonged cycles to maintain investment inflow? It is a question that could set apart the leaders from the laggards in what promises to be an intensely competitive field.